Smart, well-planned facilities management has become one of the strongest levers for improving tenant satisfaction, reducing complaints, and encouraging longer leases across the UK. When buildings are safe, comfortable, and well maintained, tenants are far more likely to renew and recommend the property to others. What tenant satisfaction really means For UK landlords and managing agents, tenant satisfaction goes beyond friendly communication; it is measured through factors such as repairs, building safety, communal space quality, and how quickly issues are resolved. Social housing providers now track Tenant Satisfaction Measures (TSMs), and the same expectations are increasingly seen in the private...

Read MoreAuthor: Estate Agents UK

From Buy‑to‑Let to Short‑Let: How Airbnb Management Services Help UK Landlords

Many UK landlords are rethinking the classic buy‑to‑let model. Slower capital growth, tighter regulation and rising costs mean long‑term tenancies no longer always deliver the returns they once did. Short‑term lets and Airbnb‑style stays, on the other hand, can generate higher gross yields in the right locations, but they also demand far more day‑to‑day work and professional standards. Short‑let and Airbnb management services bridge that gap, allowing landlords to tap into this demand without turning hosting into a second job. A growing number of companies now offer full‑service Airbnb property management across the UK, handling everything from listing creation and...

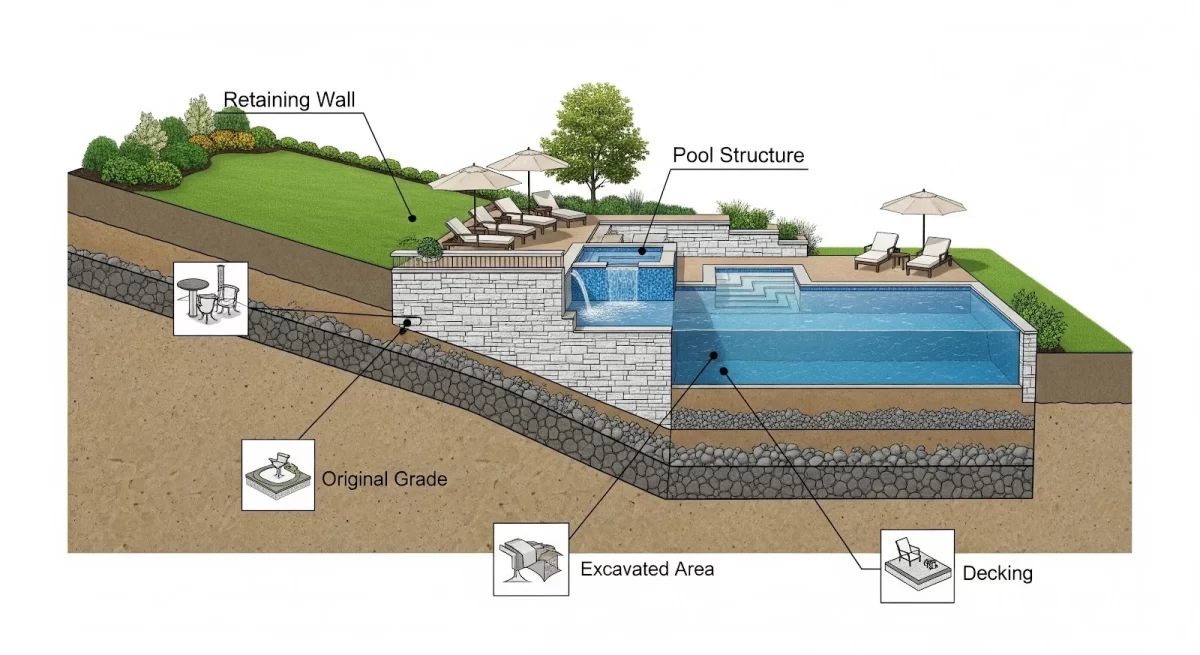

Read MoreCan You Build a Pool on a Sloping Yard?

I cannot say how many times I have found myself in the backyard of some client, gazing over a steep bank, and hearing a heavy sigh. "I suppose you have ruled out a pool, eh?" they enquire, kicking a lump of earth downhill. If this sounds like you, there is good news and a reality check. The answer is: Yes, absolutely. Actually, some of the most beautiful, award-winning pools I have ever designed were constructed on extreme slopes. A flat yard is simple, of course, but a sloping yard? The drama, the views, and the actual wow factor are found...

Read MoreWhat Are Smart Property Strategies For Landlords Managing Multiple Business Tenants?

It is easy to handle a small number of commercial tenants, but it is an entirely different ball game to manage a complete assortment of various businesses under the same roof. It is not merely space you are renting, but a mini-ecosystem with competing needs, characters, and priorities. The good news? The correct strategies will enable you to make that complexity a true advantage—you can gain stronger relationships, vacancy will decrease, and you can guarantee greater long-term value for your properties. Here is a list of clever, useful ideas that you can implement immediately. 1. Optimize Your Commercial Tenant Mix...

Read MoreReasons Companies Use Commercial Cleaning for London Properties

Modern offices need steady care to stay neat, safe, and pleasant for daily use. Businesses across the city often manage many tasks, so building upkeep often moves down the list. Many managers look for simple solutions that help teams stay focused on work tasks. Some leaders decide to hire cleaning service workers so dust, spills, and clutter never slow operations. Others use long-term plans to maintain every room, hallway, and shared zone. Clean surfaces, tidy desks, and fresh air support calm minds and better meetings. Several firms in large buildings also rely on trained cleaners because steady support brings stable...

Read MoreUkraine Industrial Assets: Should UK Property Investors Consider Them?

Most UK investors still think in terms of homes, buy‑to‑lets and maybe a small commercial unit when they hear the word “property”. A working sugar plant or agro‑industrial facility feels like another world entirely. Yet for experienced buyers looking beyond standard bricks and mortar, niche assets such as processing plants can sit alongside traditional property to create a broader, more resilient portfolio. One current example attracting international attention is a Sugar Factory for Sale in Ukraine, where buyers are weighing up long‑term demand for sugar and by‑products against operational and country‑specific risks. Top 10 Property Agents UK exists to help serious...

Read MoreMoving to Australia from UK: Wills, Trusts & Property Planning Guide

Thousands of Brits make the move Down Under each year, chasing sunnier skies and new opportunities, but what happens to your UK property and family wealth? With UK inheritance tax hitting 40% above the £325,000 threshold, while Australia has none, smart planning keeps more in your family's hands. Top 10 Property Agents UK guides you through selling, renting or transferring assets smoothly before you go. Essential Legal Steps Before Your Australia Move Start with a fresh will and enduring power of attorney – without them, UK rules dictate asset splits, potentially clashing with Aussie superannuation needs. Review every few years...

Read MoreWhy Savvy UK Homeowners Are Adding Dubai to Their Property Portfolio

The global property market keeps evolving, and more UK homeowners are discovering the benefits of diversifying their investments beyond domestic borders. Dubai has become one of the hottest international destinations offering unique opportunities for those looking to add dynamism and growth potential to their property portfolios. If you are considering expanding your horizons, it’s worth learning why Dubai stands out and how to navigate this market effectively. You can find out more on the Dubai Properties website, where the latest listings and detailed project insights help you make informed decisions tailored to your goals. Why UK Buyers Are Looking Beyond...

Read MoreIs Building a Modular House Actually Cheaper Than Buying an Existing One?

A choice between the construction of a modular house and the acquisition of an existing house is a big one and it is more so when the cost is a big concern. Prefab homes are also called modular homes, which are constructed in a factory, and then assembled at the site, and provide some potentially exclusive benefits compared to ordinary ones. Yet, what about their comparison in terms of price to the existing properties? We should deconstruct it in a relatable, educative manner. What Are Modular Homes? Modular houses are constructed in sections or modules in a carefully regulated factory...

Read MoreSeller Checklists for Preparing Homes for Sale and Legal Documentation in the UK

Selling a property in the UK requires careful preparation and organisation to achieve the best price and a smooth transaction. A comprehensive seller’s checklist helps navigate key steps from initial preparation to final legal paperwork, ensuring nothing is overlooked while enhancing your home’s appeal to buyers in 2025. Initial Planning and Choosing Professionals Choose the Right Estate Agent: Research at least three local estate agents, check their sales records, commission rates (typically 1-3%), and marketing strategies. A good agent provides accurate valuations and effective buyer outreach. Hire a Solicitor or Conveyancer: Get multiple quotes for conveyancing services (starting around £800), prioritising communication,...

Read More