Buying a property in Barnstaple in 2026 is an exciting prospect for homebuyers and investors alike. Known as the commercial heart of North Devon, Barnstaple offers a blend of coastal lifestyle, historic charm, and modern amenities. While it remains more affordable than many parts of the South West, competition for well-priced homes is increasing. To make a confident and informed purchase, buyers need a clear understanding of the local market, realistic budgeting, and a long-term view. This guide provides practical, real-world advice to help you navigate the Barnstaple property market in 2026. 1. Understand the Local Property Market Barnstaple’s housing...

Read MoreAuthor: Estate Agents UK

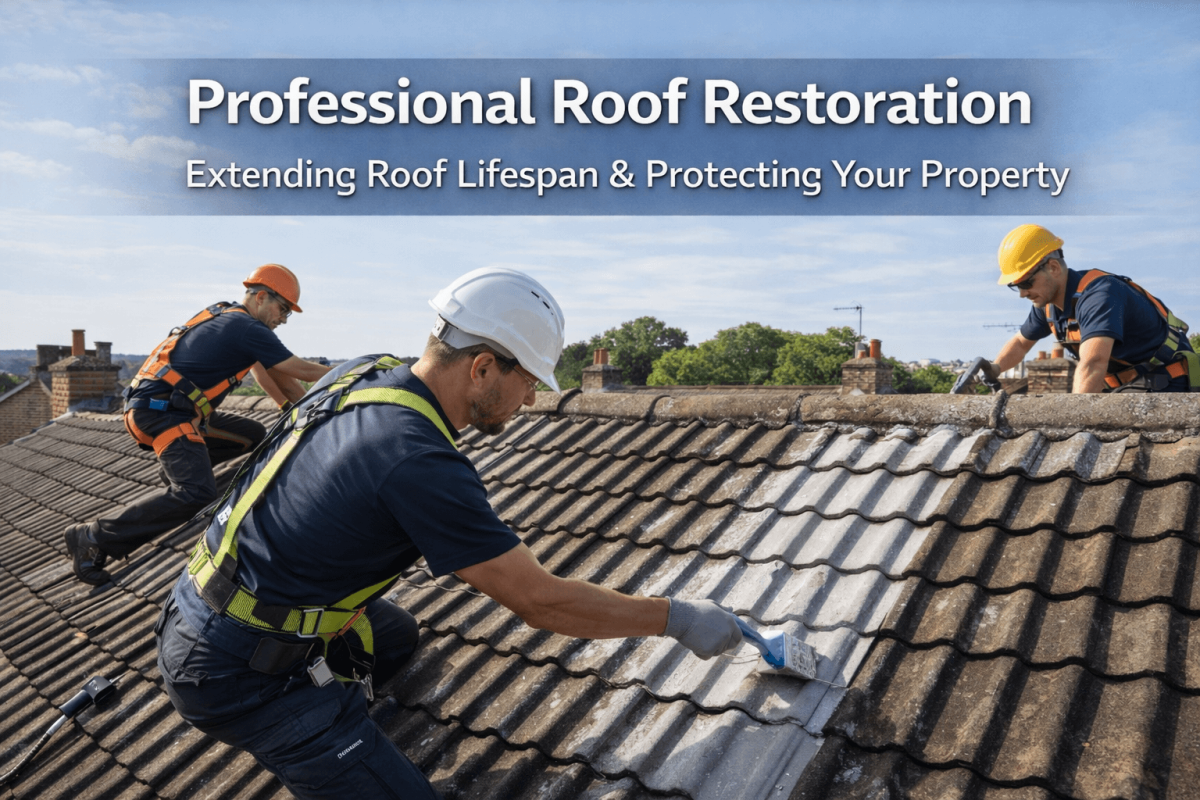

Professional Roof Restoration: Extending Roof Lifespan and Protecting Your Property

Your roof is one of the most essential parts of your property, but it is often neglected by homeowners until it is too late. A failing roof is more than just a problem for your home's structural integrity; it is a danger to your family's safety and can result in devastating financial ruin. The good news is that professional roof restoration is an effective solution that can extend the life of your roof by 15-20 years while saving you thousands of dollars in replacement costs. While roof replacement is a process of removing your existing roof and installing a brand...

Read MoreRelocating in the UK? Here’s Why Reliable, GPS-Tracked Courier Partners Are Essential

Moving home is never just about bricks, mortar, and keys. It’s also about safely moving everything that matters to you – documents, valuables, furniture, and personal belongings – from one place to another without stress. When you’re relocating anywhere in the UK, having a reliable, GPS-tracked courier or delivery partner can make the difference between a smooth move and a chaotic one. Why Courier Services Matter During Home Moves Even with a removals firm in place, there are always items that need special handling or separate transport, such as: Legal and financial documents related to your property purchase or sale...

Read MoreBlock Management in Norwich: What Property Owners Should Really Expect

Choosing the right managing agent is critical for protecting your building, finances and residents’ peace of mind. For Freeholders, RMCs and RTMs seeking reliable block management in Norwich, working with an experienced local team makes all the difference. Why Proactive Block Management Matters More Than Ever Poor management costs more than just money Reactive block management often leads to delayed maintenance, frustrated residents and escalating compliance risks. A proactive approach focuses on prevention, communication and long-term planning. Effective block management in Norwich should include: Regular property inspections with documented reporting Forward-planned maintenance and capital expenditure Clear service charge budgets and...

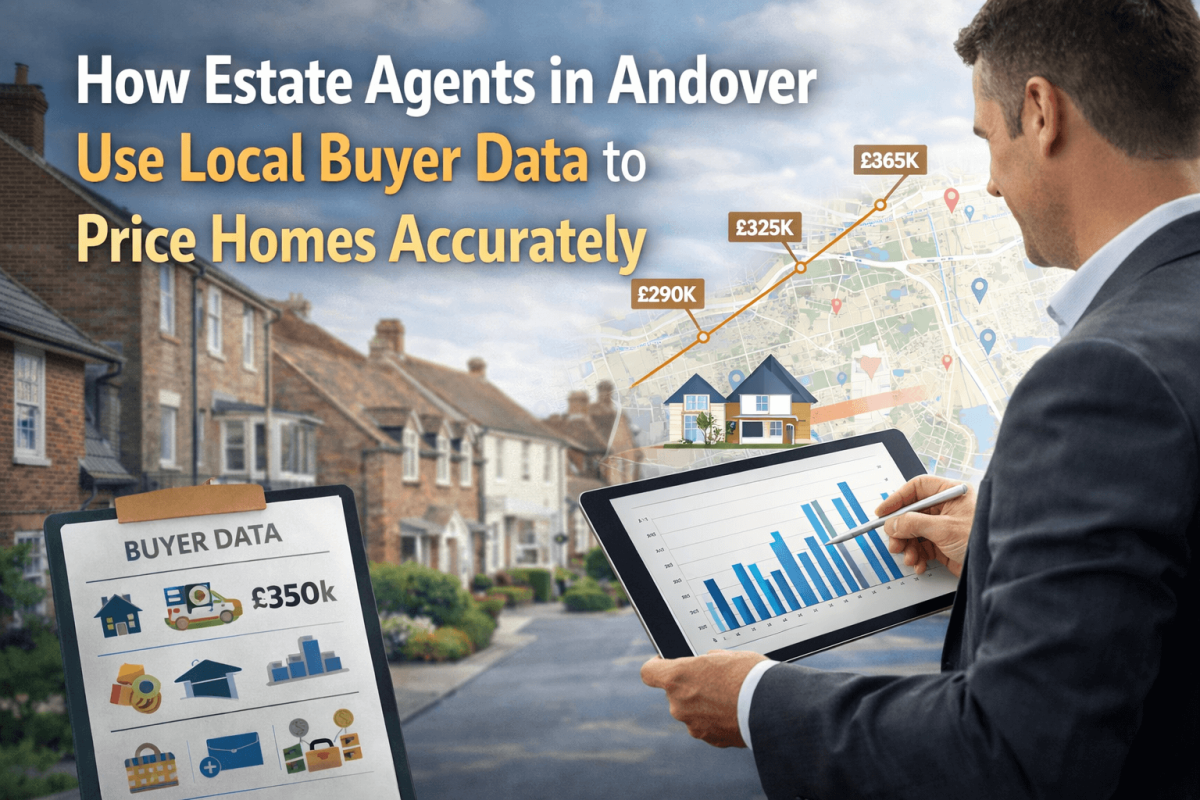

Read MoreHow Estate Agents in Andover Use Local Buyer Data to Price Homes Accurately

Setting the right asking price is one of the most important decisions when selling a property. In Andover, accurate pricing is rarely based on guesswork or generic online tools. Instead, experienced estate agents rely on detailed local buyer data to ensure homes are priced in line with real demand. Working with an Andover local agent like Belvoir means pricing decisions are informed by live buyer behaviour, current demand and local market dynamics, not just historic averages. For homeowners, landlords and investors, this data-led approach can significantly reduce time on the market while protecting property value. Understanding Who Is Actively Buying...

Read MoreSelling a Property With Estate Agents: A Practical Checklist for Homeowners

Selling a property can feel overwhelming, particularly if it’s your first time navigating the process. From choosing the right professional support to preparing your home for viewings and negotiating offers, there are many moving parts that need careful attention. Working with an experienced estate agent can make the journey smoother, faster, and more secure. Whether you are upsizing, downsizing, or relocating, having a clear checklist helps you stay organised and confident throughout the sale. If you are considering professional support, many sellers begin their journey with trusted local experts such as Whitegates Wolverhampton Estate Agents, ensuring local knowledge and market insight are on their...

Read More7 Legal Mistakes Landlords Must Avoid in the UK

Becoming a landlord in the UK can be a rewarding investment strategy, but it also comes with significant legal responsibilities. Over the past decade, housing legislation has tightened considerably, placing greater accountability on property owners to ensure tenant safety, fair treatment and regulatory compliance. Whether you are a first-time landlord or expanding an existing portfolio, understanding the most common legal pitfalls is essential. Even seemingly minor oversights can result in fines, rent repayment orders or difficulties regaining possession of your property. Below are seven legal mistakes landlords must avoid — and what to do instead. 1. Failing to Protect the...

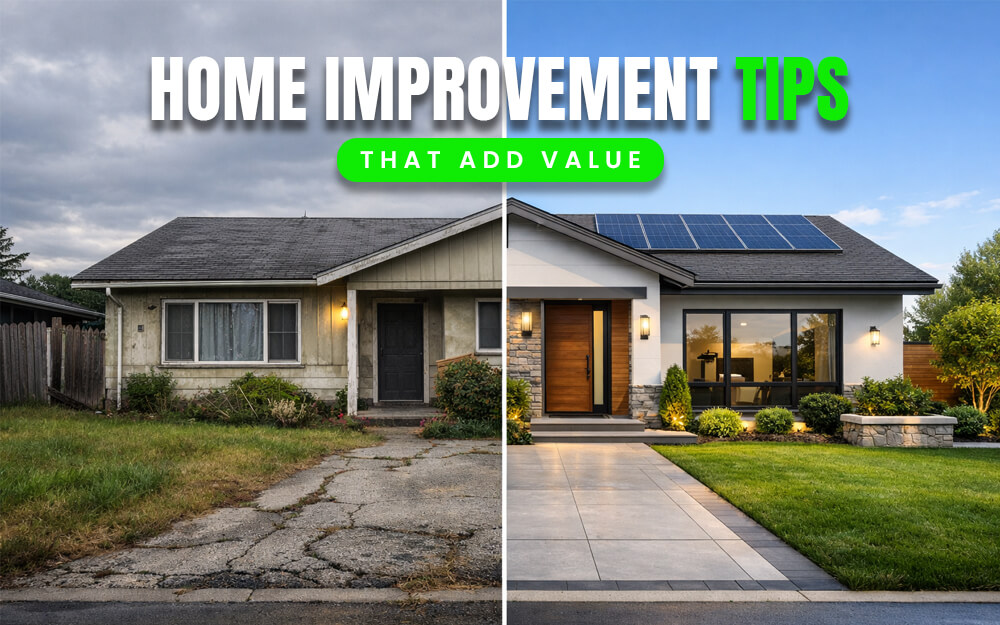

Read MoreHome Improvements That Add Value: Essential Tips for the Modern Homeowner

Home improvement is not just about keeping up with the latest trends. It’s also about increasing the functionality, aesthetics, and value of your property. Whether you’re looking to sell, rent, or simply create a more comfortable living environment, there are numerous ways to improve your home. From small upgrades to larger renovations, each project can play a role in elevating your living space. This article explores key home improvement ideas that not only improve your home’s appeal but also contribute to its long-term value. We’ll also highlight affordable yet impactful solutions such as repair worktops and window film, which can...

Read MoreHow to sell a business successfully in the UK

Selling a business in the UK can be a great exit, but it’s rarely a simple “list it and wait” process. In reality, the final result depends on a few fundamental things: how well prepared you are, how clear and believable your numbers look, and how confidently a buyer can move through due diligence without running into surprises. Serious buyers don’t buy stories or promises. They buy proof. It is many offers in UK, just see listings of businesses for sale - https://en-gb.yescapo.com/business-for-sale/. Proof that the financials are accurate. Proof that the business can operate without constant owner involvement. Proof that the...

Read MoreAdvanced 3D Booth Design: From Vision to Victory

3D booth design tools are revolutionizing exhibitions, bridging the gap between imagination and execution. No longer confined to 2D sketches, creators now render hyper-realistic models, test interactions, and collaborate in real-time—slashing costs and timelines by up to 50%. For pros tackling CES booth designs or modular trade show setups, this tech is indispensable. Why 3D Transforms Trade Shows Traditional methods breed errors: misjudged scales, clashing materials, last-minute fixes. 3D platforms simulate physics, lighting, and human flow, delivering photorealistic previews indistinguishable from the real build. Key features: Real-time rendering: Drag-drop furniture, tweak textures instantly. Material libraries: Accurate woods, metals, fabrics with...

Read More